|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

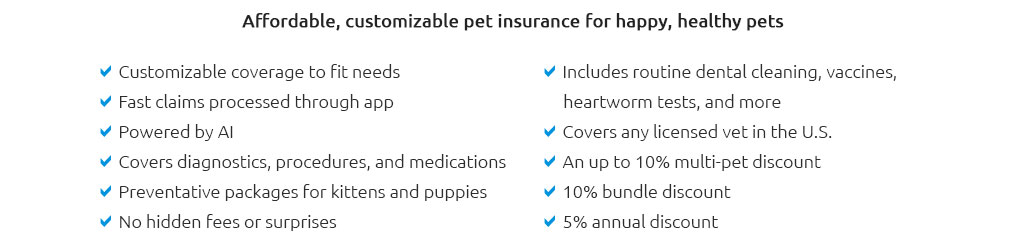

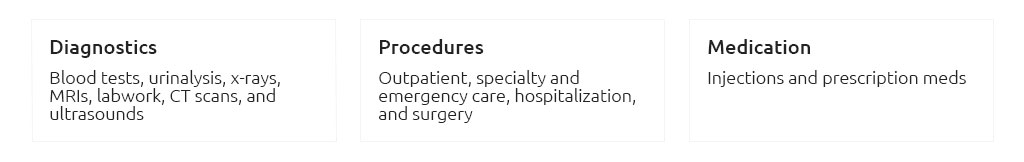

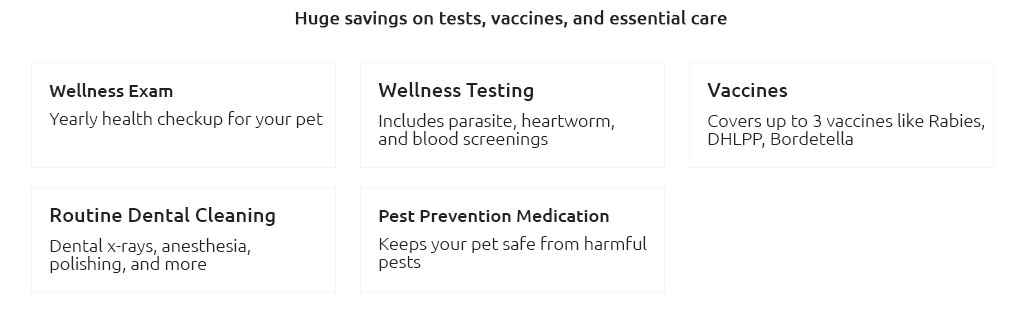

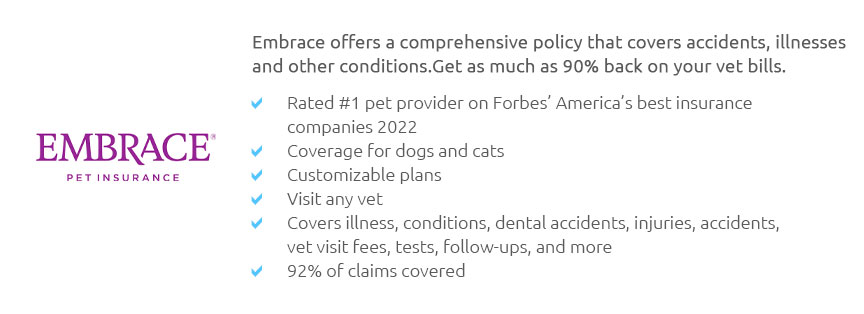

Exploring Pet Insurance in New Hampshire: A Comprehensive GuideNew Hampshire, with its picturesque landscapes and vibrant communities, is a haven not only for its human residents but also for their beloved pets. As more pet owners recognize the importance of safeguarding their furry family members, pet insurance has emerged as a crucial consideration. In this article, we delve into the nuances of pet insurance in New Hampshire, shedding light on its significance, benefits, and considerations for pet owners. The Granite State, known for its rugged mountains and serene lakes, offers a unique environment for pets to thrive. However, with this idyllic setting comes the unpredictability of life, where accidents and illnesses can occur unexpectedly. Pet insurance serves as a financial safety net, providing peace of mind to pet owners who want to ensure their companions receive the best possible care without the burden of exorbitant veterinary bills. Why Consider Pet Insurance? The primary allure of pet insurance lies in its ability to mitigate the financial strain associated with veterinary emergencies. Whether it’s a sudden injury from an adventurous hike in the White Mountains or a chronic condition requiring ongoing treatment, having insurance can make a significant difference. Moreover, pet insurance often covers preventive care, such as vaccinations and routine check-ups, fostering a proactive approach to pet health. Types of Coverage In New Hampshire, pet owners have access to a variety of insurance plans tailored to different needs and budgets. Accident-only plans are ideal for those who want basic coverage for unexpected incidents, while comprehensive plans offer more extensive protection, including illnesses and preventive care. Some insurers even provide customizable plans, allowing pet owners to tailor coverage according to their pet’s specific requirements. One crucial aspect to consider is the breed-specific conditions. Certain breeds are predisposed to specific health issues, and understanding these risks can guide owners in selecting an appropriate plan. For example, Labrador Retrievers, a popular breed in New Hampshire, are prone to hip dysplasia, making it prudent to choose a policy that covers hereditary conditions. Choosing the Right Provider When selecting a pet insurance provider in New Hampshire, it’s essential to conduct thorough research. Factors such as the insurer’s reputation, claim process efficiency, and customer service quality are pivotal. Reading reviews and seeking recommendations from local veterinarians can provide valuable insights into a provider’s reliability and responsiveness. Another consideration is the cost of premiums. While affordability is crucial, it should not be the sole determinant. A cheaper plan might offer limited coverage, leading to higher out-of-pocket expenses during emergencies. Striking a balance between cost and coverage is key to ensuring comprehensive protection for your pet. Furthermore, pet owners should be aware of policy exclusions and limitations. Most insurers do not cover pre-existing conditions, and understanding these exclusions upfront can prevent unpleasant surprises during a claim. Embracing Preventive Care In addition to accident and illness coverage, many pet insurance plans in New Hampshire emphasize the importance of preventive care. Routine check-ups, vaccinations, and dental cleanings are crucial components of a pet’s overall well-being. By integrating preventive care into insurance plans, providers encourage pet owners to prioritize regular veterinary visits, ultimately enhancing the quality and longevity of pets’ lives. In conclusion, pet insurance in New Hampshire is an invaluable resource for pet owners seeking to safeguard their companions against the uncertainties of life. By understanding the different types of coverage, selecting a reputable provider, and embracing preventive care, pet owners can ensure their furry friends receive the best possible care, allowing them to enjoy the beauty of New Hampshire without worry. Frequently Asked QuestionsWhat does pet insurance typically cover? Pet insurance generally covers accidents, illnesses, surgeries, and emergency care. Some plans also include preventive care like vaccinations and routine check-ups. Are there breed-specific exclusions in pet insurance? Yes, some insurers have breed-specific exclusions for conditions that are hereditary or common in certain breeds. It’s important to review these details when choosing a policy. How are premiums determined for pet insurance? Premiums are typically based on factors like the pet’s age, breed, location, and the type of coverage selected. Comprehensive plans tend to have higher premiums. Can I switch pet insurance providers easily? While you can switch providers, it’s important to note that pre-existing conditions may not be covered by the new insurer, so transitioning should be carefully considered. Is pet insurance worth it for older pets? While premiums may be higher for older pets, insurance can still be beneficial as they are more susceptible to health issues, making coverage advantageous for managing costs. https://www.petinsurancereview.com/pet-insurance/NH

We compare prices from pet insurance providers across the state that have proven track records for quality coverage and a willingness to stand by pet parents ... https://www.insurance.nh.gov/news-and-media/new-hampshire-governor-sununu-signs-hb249-law-introducing-comprehensive-pet

CONCORD, NH (July 28, 2023) Today, the New Hampshire Insurance Department (NHID) announces that Governor Chris Sununu has signed HB249 into ... https://www.metlifepetinsurance.com/state/new-hampshire/

Want to learn more? ... There is no substantive difference between a MetLife Pet Insurance policy in New Hampshire and a MetLife Pet policy in ...

|